CODY, Wyo. — As the Wyoming State Loan and Investment Board prepares to meet Thursday to consider a proposed $9.87 million low-interest loan for pharmaceutical ingredient manufacturer Cody Laboratories, the applicant’s parent company finds itself at the center of a growing national backlash over spiraling prescription drug prices.

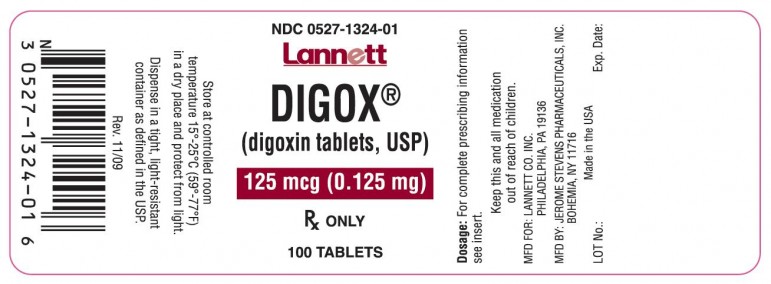

Cody Labs is a wholly owned subsidiary of Philadelphia-based Lannett Co., a generic pharmaceutical manufacturer founded in 1942 and valued at nearly $1 billion. Lannett has hiked prices on some of its key products by more than 800 percent in recent years.

Lannett’s aggressive drug pricing has raised questions with state and federal investigators. It has also resulted in a flurry of civil lawsuits alleging that the company conspired with competitors to fix prices on certain medicines, costing patients, taxpayers and public and private health care funding agencies millions in unnecessary expenses.

The company has denied wrongdoing, releasing a September 2014 statement detailing a voluntary internal review conducted by outside counsel that “included the examination of well over 700,000 documents,” according to CEO Arthur Bedrosian.

Statements Lannett has filed with the federal Securities and Exchange Commission maintain that the company “has acted in compliance with all applicable laws and regulations.”

Lannett spokesman Robert Jaffe said in an email that the Cody Labs facility “is focused on the development and manufacture of medications for the treatment and management of pain,” and is not involved in the production of Digoxin or Ursodiol, two drugs that have been the subject of intense scrutiny for steep price hikes.

In July 2014, Lannett and Impax Laboratories, a California-based generic drugmaker, received subpoenas from the Connecticut Attorney General’s Office requesting information about the pricing of Digoxin, a generic heart medicine.

Lannett’s senior vice president of sales and marketing received a federal grand jury subpoena in November 2014 seeking corporate documents relating to communications or correspondence with competitors regarding the sale of generic prescription medications, according to the company’s SEC filings.

The Company was served with a separate but apparently related federal grand jury subpoena in December 2014 seeking similar documents. Lannett states in SEC filings that it has provided documents to the U.S. Department of Justice and “continues to cooperate with the federal investigation.”

Widening scrutiny

Since 2014, several other generic drugmakers have reported receiving DOJ grand jury subpoenas—including one issued as recently as last month to an Israeli generic drugmaker — in what appears to be a broad investigation into possible antitrust violations regarding generic drug prices.

Justice Department spokesman Mark Abueg declined to comment.

Responding to consumer complaints and a request from the National Community Pharmacists Association, Congress has also looked into the generic industry’s price hikes.

In November 2014, just as Lannett was asking Wyoming taxpayers to kick in $2.5 million through the Wyoming Business Council toward a new drug storage warehouse in Cody, Bedrosian was asked to appear at a Congressional hearing on what government documents described as “staggering price increases” for generic drugs.

Over the previous two years, Lannett had hiked the price of Digoxin, its generic heart medicine, by 1,000 percent after one of two other suppliers stopped making the drug, according Congressional documents.

Bedrosian declined to testify before Congress, citing a conflicting trip to London to meet with potential investors. In a 2014 fourth-quarter earnings conference call with investors and analysts, Bedrosian reported the highest net sales, highest gross margins and highest net income in company history, telling analysts that “we are an opportunistic company,” and “we see opportunities to raise prices.”

Lannett’s competitor, Mylan NV, has been the subject of additional Congressional hearings and particularly intense public outcry for sharply raising the price of its EpiPen, a patented injector of a generic drug for allergic reactions. Mylan is also among the companies being investigated by DOJ.

But in May 2014, it was Lannett leading the way on a price hike for the generic gallstone medicine Ursodiol, which had been available for about 50 cents per pill. Mylan soon followed suit, along with six other companies, with all eight companies increasing their Ursodiol prices to around $5 per pill.

Both Hillary Clinton and Donald Trump have condemned drug companies for such practices, and both presidential candidates are calling for Medicare to negotiate on drug pricing, along with additional measures aimed at curbing drug prices.

Loren Grosskopf is a Park County Commissioner who also volunteers as treasurer for Forward Cody, the nonprofit economic development group working to secure public funds for Cody Labs’ expansion.

Grosskopf said the federal investigation raised no concerns for him about supporting the loan for Cody Labs, and that such price hikes were “just how business works.”

“You or I would do the same thing if we could,” he said. “About all you can do is try to shame them.”

Patients suffer

Mike Wenke, a pharmacist at Medical Center Pharmacy in Cody, said he recalled how quickly the price of Digoxin shot up, as it “took maybe a 10-fold increase overnight.”

Wenke’s pharmacy is part of a 2,000-store cooperative that helps it bargain with suppliers, but patients are often hit much harder by such swift and severe price hikes.

“It’s definitely the patient who suffers,” he said, particularly those without insurance or whose deductibles are not yet met. Price hikes like Lannett’s for Digoxin and Ursodiol result in higher insurance premiums and drive up costs for Medicare, which is funded by taxpayers.

“In the end, it all trickles down to the patient,” Wenke said.

Some drug companies establish rebates or other patient assistance programs for those who can’t afford key medicines. Lannett states on its website that it offers no such assistance, because “as a generic drug manufacturer, Lannett lowers the costs to consumers by offering products at greatly reduced prices versus brand.”

Wenke said streamlining the federal drug approval process would help increase competition. And reforming the market for pharmacy benefit managers — intermediaries between producers and insurers — would also help reduce drug costs.

“But another reason why generics have jumped in price is a lot of the companies are buying each other up,” he said, “so competition is going away.”

Lannett paid $1.23 billion in 2015 to acquire New Jersey-based drug maker Kremers Urban Pharmaceuticals Inc. Lannett also paid $41.9 million in cash last year to buy privately held Silarx Pharmaceuticals, Inc., a New York-based manufacturer and marketer of liquid generic pharmaceuticals.

Lannett doubled in size over the last year, accumulating outstanding debt of nearly $1.2 billion. Some of that debt was initially financed at double-digit interest rates, a situation that makes even a relatively small low-interest loan from Wyoming taxpayers all the more attractive.

Pharmaceutical firms must continue getting bigger or risk being swallowed up themselves. As companies look to drive profits, pay down debt and accumulate cash for acquisitions, it could mean even more aggressive drug price increases for patients.

It also means that not just Cody’s local economy will benefit from public assistance given to Lannett, but the company’s out-of-state executives and shareholders as well.

That includes Bedrosian, Lannett’s CEO who touted record profits but declined to testify before Congress. Bedrosian’s total compensation for 2015 was $3.7 million, and as of August, he directly held more than 600,000 shares in Lannett.

Contact Ruffin Prevost at [email protected] or 307-213-9818.